[Music] the changing world order

the times ahead will be radically different from those that we’ve experienced in our lifetimes

though similar to many times before how do i know that because they always have been

[Music] over my roughly 50 years of global

macroeconomic investing i’ve learned the hard way that the most

important events that surprised me did so because they never happened in my

lifetime these painful surprises led me to study the last 500 years of history for

similar situations where i saw that they had indeed happened many times before

with the ups and the downs of the dutch [Music]

and every time they did it was a sign of the changing world order

this study taught me valuable lessons that i’m going to pass along to you here in a distilled form

you can find the comprehensive version in my book principles for dealing with

the changing world order let me begin with a story that brought

me to this point about how i learned to anticipate the future by studying the

in 1971 when i was a young clerk on the floor of the new york stock exchange the

united states ran out of money and defaulted on its debts that’s right the u.s ran out of money

how well back then gold was the money used in transactions between countries

paper money like the dollar was like checks in a checkbook in that it had no

value other than it could be exchanged for gold which was the real money

at the time the united states was spending a lot more money than it was earning by writing a lot more of these

paper money checks than it had gold in the bank to exchange for them as people turned these checks into the

bank for gold money the amount of gold in the u.s started to dwindle it soon

became obvious that the u.s couldn’t keep its promises for all the existing paper money so people holding dollars

rush to exchange them before the gold ran out recognizing that the u.s was going to

run out of real money on sunday evening august 15th president

nixon went on television to tell the world that the us was breaking its promise to let people exchange their

dollars for gold of course he didn’t say it that way he said it more diplomatically without making it clear

that the united states was defaulting strength of a nation’s currency is based on the strength of that nation’s economy

and the american economy is by far the strongest in the world accordingly i have directed the

secretary of the treasury to take the action necessary to defend the dollar

against the speculators i have directed secretary connelly to suspend temporarily the convertibility

of the dollar into gold or other reserve assets except in amounts and conditions

determined to be in the interest of monetary stability and in the best interest of the united states

i watched in ore realizing that money as we understood it was ending

what a crisis i expected the stock market to plunge

the next day so i got on the exchange floor early to prepare when the opening bell rang pandemonium

broke out but not the kind i expected the market was up

way up and went on to rise nearly 25

that surprised me because i never experienced a currency devaluation

before when i dug into history i discovered that the exact same thing happened in

1933 and had the exact same effect then paper dollars were also linked to gold

which the us was running out of because it was spending more paper money checks

then it had gold to exchange for them and president roosevelt announced on the

radio that he would break the country’s promise to exchange dollars for gold it

was then that i issued the proclamation providing for the national bank holiday

and this was the first step in the government’s reconstruction of our financial and economic fabric

the second step last thursday was the legislation promptly and

patriotically passed by the congress confirming my proclamation and broadening my powers

so that it became possible in view of the requirement of time to extend the holiday and lift the ban

of that holiday gradually in the days to come this law also gave authority

in both cases breaking the link to gold allowed the us to continue spending more

than it earned simply by printing more paper dollars since there was an increase in the

number of dollars without an increase in the country’s wealth the value of each

dollar fell as these new dollars entered the market

without a corresponding increase in productivity they went to buy lots of

stocks gold and commodities and hence caused their prices to rise

as i studied more history i saw that the exact same thing happened many many

times before i saw that since the beginning of time when governments spent much more than

they took in in taxes and conditions got bad they ran out of money and they needed

more so they printed more a lot more which made its value full and made the

prices of most everything including stocks gold and commodities rise

that’s when i first learned the principle that when central banks print a lot of money to relieve a crisis buy

stocks gold and commodities because their value will rise and the value of

paper money will fall this printing of money is also what happened in 2008 to

relieve the mortgage driven debt crisis and in 2020 to relieve the pandemic-driven economic

crisis and it almost certainly will happen in the future so i suggest that you keep this

principle in mind these experiences gave me another principle which is to understand what is

coming at you you need to understand what happened before you that principle led me to study how the

roaring 20s bubble turned into the 1930s depression

which gave me the lessons that allowed me to anticipate and profit from the 2007 bubble

turning into the 2008 bust [Music]

all these experiences led me to develop an almost instinctual urge to look to

the past for similar situations to learn how to handle the future well

over the last few years three big things that hadn’t happened in my lifetime prompted me to do this study

first countries didn’t have enough money to pay their debts even after lowering interest rates to

zero so their central banks began printing lots of money to do so

second big internal conflicts emerge due to growing gaps in wealth and values this

showed up in political populism and polarization between the left who want to redistribute wealth and the right who

want to defend those holding the wealth and third increasing external conflict

between a rising great power and the leading great power as is now happening with china and the united states

so i looked back i saw that all these had happened together before many times

and nearly always led to changing domestic and world orders the last time this sequence happened was

from 1930 to 1945. what exactly is an order you might ask

it’s a governing system for people dealing with each other there are internal orders for governing

within countries typically laid out in constitutions and there is a world order for governing

between countries typically laid out in treaties internal orders change at different

times than world orders the weather within or between countries these orders typically change after wars

civil wars within countries international wars between countries

they happen when revolutionary new forces defeat weak old orders

for example the u.s internal order was laid out in the constitution in 1789

after the american revolution and it is still operating today even after the

american civil war russia got rid of its old order and established a new one with the russian

revolution in 1917 which ended in 1991 with a relatively bloodless revolution

china began its current internal order in 1949 when the chinese communist party

won the civil war you get the idea the current world order commonly called

the american world order formed after the allied victory in world war ii when

the u.s emerged as the dominant world power it was set out in agreements and

treaties for how global governance and monetary systems work in 1944 the new

world monetary system was laid out in the bretton woods agreement and established the dollar as the world’s

leading reserve currency a reserve currency is a currency that is

commonly accepted around the world and having one is a key factor in a country

becoming the richest and most powerful empire with a new dominant power and monetary

system established a new world order begins these changes take place in a timeless

and universal cycle that i call the big cycle

i’ll start with a quick overview then give you a more complete version

and then direct you to my book if you want more as i studied the 10 most powerful

empires over the last 500 years and the last three reserve currencies

it took me through the rise and decline of the dutch empire and the gilder

the british empire and the pound the rise and early decline in the united

states empire in the dollar and the decline and rise of the chinese

empire and its currencies as well as the rise and decline of the spanish

german french indian japanese russian and ottoman empires

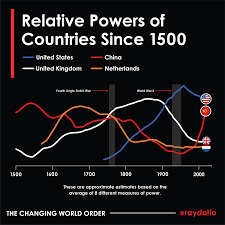

along with their significant conflicts as measured in this chart

to understand china’s patterns better i also studied the rise and fall of chinese dynasties and their monies back

to the year 600 because looking at all these measures at once can be confusing i’ll focus on the

four most important ones the dutch british us and chinese

you’ll quickly notice the pattern now let’s simplify the form a bit

as you can see they transpired in overlapping cycles that lasted about 250

years with 10 to 20 year transition periods between them typically these transitions have been

periods of great conflict because leading powers don’t decline without a

fight so how am i measuring an empire’s power

in this study i used eight metrics each country’s measure of total power is

derived by averaging them together they are education inventiveness and technology

development competitiveness in global markets economic output share of world

trade military strength the power of their financial center for capital markets and

the strength of their currency as a reserve currency because these powers are measurable we

can see how strong each country is now was in the past and whether they’re

rising or declining by examining the sequences from many

countries we can see how a typical cycle transpires

and because the wiggles can be confusing we can simplify it a bit to focus on the

pattern of cause effect relationships that drive the rise and decline of a

typical empire as you can see better education typically leads to increased innovation

and technology development and with a lag the establishment of the currency as

a reserve currency you can also see that these forces then declined in a similar order reinforcing

each other’s decline let’s now look at the typical sequence of events going on inside a country that

produces these rises and declines in a nutshell the big cycle typically

begins after a major conflict often a war establishes the new leading power

and the new world order because no one wants to challenge this power a period of peace and prosperity

typically follows as people get used to this peace and prosperity they increasingly bet on it

continuing they borrow money to do that which eventually leads to a financial

bubble the empire’s share of trade grows and when most transactions are conducted in

its currency it becomes a reserve currency which leads to even more borrowing

at the same time this increased prosperity distributes wealth unevenly

so the wealth gap typically grows between the rich haves and the poor have-nots

eventually the financial bubble bursts which leads to the printing of money

and increased internal conflict between the rich and the poor which leads to some form of revolution to redistribute

well this can happen peacefully or as a civil war while the empire struggles with this

internal conflict its power diminishes relative to external rival powers on the

rise when a new rising power gets strong enough to compete with the dominant

power that is having domestic breakdowns external conflicts most typically wars take place

out of these internal and external wars come new winners and losers

then the winners get together to create the new world order and the cycle begins again

as i looked back i saw that these cause and effect relationships drove the cycles of rises and declines all the way

back to the roman empire i saw how the stories of each one of these cycles

blended together with others before during and after in the same way as each

individual story blends with others to make the epic 500 year story that is our

collective history and like human life

no cycles are exactly the same but most are similar they’re driven by logical cause and

effect relationships that progress through stages from birth to strength and maturity

to weakness and inevitably decline however that’s like saying a person’s

life cycle takes 80 years on average without recognizing that many are much

shorter and many are longer while age can be a good indicator of

future longevity a better way is to look at health indicators

one can do that with empires and they’re vital signs too i found that by watching the indicators

of power change i was able to see what stage a country was in which helped me

to anticipate what was likely to come next now i’ll take you through the big cycle

in more detail give me 20 minutes and i’ll give you the last 500 years of history

and show you the similar patterns across the dutch british us

and chinese empires 500 years of big cycles

i’m going to describe the typical cycle by dividing it into three phases

the rise the top and the decline the rise

successful new waters that rise both internal and external are typically

started by powerful revolutionary leaders doing four things

first they win power by gaining more support than the opposition

second they consolidate power by converting weakening or eliminating the

opposition so they don’t stand in their way third they establish systems and

institutions that make the country work well and fourth they pick their successors well or create systems that

do that because a great empire requires many great leaders over several generations

at this stage soon after winning the fight there is typically a period of peace and

growing prosperity because the leadership is clearly dominant and has broad support so no one wants to fight

it during this phase leaders within the country have to design an excellent

system to raise the country’s wealth and power first and foremost to be great

they must have strong education which is not just teaching knowledge and skills

but also strong character civility and work ethic

these are typically taught in the family schools and religious institutions that provides a healthy respect for rules and

laws order within society low corruption and enables them to unite behind a

common purpose and work well together as they do this they increasingly shift

from producing basic products to innovating and inventing new

technologies [Music] for example the dutch rose to defeat the

habsburg empire and become superbly educated they became so inventive that they came up with a

quarter of all major inventions in the world the most important of which was

the invention of ships that could travel around the world to collect great riches

and the invention of capitalism as we know it today to finance those voyages

they like all leading empires enhance their thinking by being open to the best thinking in the world

as a result the people in the country become more productive and more competitive in world markets which shows

up in their growing economic output and rising share of world trade

you can see this happening now as the us and china are roughly comparable in both

their economic outputs and their shares of world trade

as countries trade more globally they must protect their trade routes and their foreign interests from attack so

they develop great military strength if done well this virtuous cycle leads to

strong income growth which can be used to finance investments

in education infrastructure and research and development they must also develop

systems to incentivize and empower those that have the ability to make or take

wealth in all of these cases the most successful empires used a capitalist approach

[Music] to develop productive entrepreneurs

even china which is run by the chinese communist party used the form of this

capitalist approach [Music]

deng xiaoping when asked about this said it doesn’t matter if it’s a white cat or

a black cat as long as it catches mice and it’s glorious to be rich

to do this well they must develop their capital markets most importantly their lending

bond and stock markets that allows people to convert their savings into investments

to fund invention and development and share in the successes of those who

make great things happen the dutch created the first publicly listed company the dutch east india

company and the first stock market to fund it which were integral parts of the

system that produced massive wealth and power as a natural consequence the greatest

empires developed the world’s leading financial centers for attracting and distributing the world’s capital

amsterdam was the world’s financial center when the dutch were preeminent

london when the british were on top new york is now and china is quickly developing its

financial centers most importantly the capitalists the

governments and the military must work together not only did the dutch work well

together they were one in the same the dutch east india company was granted

a trade monopoly from the government and had its own officially sanctioned military to go out into the global

markets to make and take wealth the british followed with the british

east india company and had a similar coordination of their government business and military operations

the u.s military-industrial complex followed suit as does the chinese system today

as the country becomes the largest international trading empire its transactions can be paid with its

currency making it the preferred global medium of exchange

and because their currency is so widely accepted and frequently used people

around the world want to save in it making it the preferred storehold of

wealth and thus the world’s leading reserve currency

the gilder was the world’s main reserve currency when the dutch-led world trade

the pound was when the british led and the dollar has been since the u.s

led naturally china’s currency is increasingly being used as a reserve

currency having a reserve currency enables the empire to borrow more than other

countries that advantage is huge [Music]

think about it people all over the world are eager to save and hence lend back

their currency to the empire countries without a reserve currency don’t have that

and when the empire runs out of its own money remember the united states in 1971

they can always print more the exorbitant privilege afforded by the

empire’s reserve currency leads borrowing to increase and the beginning of a financial bubble

this series of cause-and-effect relationships leading to mutually supportive financial political and

military powers bolstered by the borrowing power of a reserve currency have gone together since history began

to be recorded all the empires that became the most powerful in the world

followed this path to the top

while in the top phase most of these strengths are sustained embedded within

the fruits of their success are the seeds of their decline as a rule as people in these rich and

powerful countries earn more that makes them more expensive and less

competitive relative to people in other countries who are willing to work for less

at the same time people in other countries naturally copy the methods and technologies of the leading power which

further reduces the leading power’s competitiveness for example british shipbuilders had

less expensive workers than dutch shipbuilders so they hired dutch designers to design

better ships that were built by less expensive british workers making them more

competitive which led the british to rise and the dutch to decline

also as people become richer they tend not to work as hard they enjoy more leisure pursue the finer

and less productive things in life and at the extreme become decadent

values change from generation to generation during the rise to the top from those who had to fight to achieve

wealth and power to those who inherited it they’re less battle-hardened steeped in

luxuries and accustomed to the easy life which makes them more vulnerable to challenges the golden era of the dutch

and the victorian era of the british empire

[Applause] were such high prosperity periods like

this as people get used to doing well they increasingly bet on the good times

continuing and borrow money to do that which grows into financial bubbles

naturally the financial gains come unevenly so the wealth gap grows

wealth gaps are self-reinforcing because rich people use their greater resources

to reinforce their powers for example they give greater privileges to their children like better education

and they influence the political system to their advantage this causes the gaps in values politics

and opportunities to grow between the rich haves and the poor have-nots

those who are less well-off feel the system is unfair so resentments grow but

as long as the living standards of most people are still rising these gaps and resentments don’t boil over into

conflict having the world’s reserve currency inevitably leads to borrowing

excessively and contributes to the country building up large debts with foreign lenders while this boosts

spending power over the short term it weakens the country’s financial health and weakens the currency over the

long term in other words when borrowing and spending are strong the empire appears

very strong but its finances are in fact being weakened [Music]

the borrowing sustains the country’s power beyond its fundamentals by financing both domestic over consumption

and international military conflicts required to maintain the empire

inevitably the cost of maintaining and defending the empire becomes greater than the revenue it brings in so having

an empire becomes unprofitable for example the dutch empire overextended around the world

and fought war after increasingly expensive war with the british and other

european powers to protect its territory and trade routes the british empire similarly became massive bureaucratic

and lost its competitive advantages as rival powers particularly germany sword

leading to an increasingly expensive arms race and world war

the u.s has spent about eight trillion dollars on foreign wars and their consequences since september 11

and trillions more for other military operations and for supporting military

bases in 70 countries and it still isn’t spending enough to

support its military competition with china in the area around china

in this cycle the richer countries eventually get deeper into debt by borrowing from poorer countries that

save more it’s one of the early signs of a wealth and powershift this started in the united states in the

1980s when it had a per capita income 40 times that of china’s and started

borrowing from chinese who wanted to save in dollars because the dollar was the world’s reserve currency

similarly the british borrowed a lot of money from its much poorer colonies

and the dutch did the same at their top if the empire begins to run out of new

lenders those holding their currency begin to look to sell and get out

rather than to buy save lend and get in

[Music] and the strength of the empire begins to

decline the decline the decline comes from internal economic

weakness together with internal fighting or costly external fighting or both

typically the decline comes gradually and then very suddenly

when debts become very large and there is an economic downturn

and the empire can no longer borrow the money necessary to repay its debts

the financial bubble bursts this creates great domestic hardships

and forces the country to choose between defaulting on its debts or printing a lot of new money

it always chooses to print a lot of new money at first gradually and eventually

massively that devalues the currency and raises

inflation for the dutch this was the financial crisis brought about by financial

excesses and paying for the fourth anglo-dutch war similarly for the british it was paying

for its financial excesses and its debts from the two world wars

and for the u.s it’s been three cycles of debt finance booms and busts since

the 90s with the central bank stepping in each time with stronger measures

when the government has problems funding itself when there are bad economic conditions

and living standards for most people are declining and there are large wealth

values and political gaps internal conflict between the rich and

the poor as well as different ethnic religious and racial groups greatly

increases this leads to political extremism that shows up as populism of

the left or the right those of the left seek to redistribute the wealth while

those of the right seek to maintain the wealth in the hands of the rich typically during such times taxes on the

rich rise and when the rich fear their wealth and well-being will be taken away

they move to places assets and currencies they feel safer in these outflows reduce the empire’s tax

revenue which leads to a classic self-reinforcing hollowing out process

when the flight of wealth gets bad enough governments outlaw it those seeking to get out begin to panic

these turbulent conditions undermine productivity which shrinks the economic pie and

causes more conflict about how to divide the shrinking resources populous leaders emerge from both sides

and pledge to take control and bring about order that’s when democracy is most challenged

because it fails to control the anarchy and it is when the move to a strong populous leader who will bring order to

the chaos is most likely as conflict within the country escalates it leads to some form of revolution or

civil war to redistribute wealth and force the necessary big changes

this can be peaceful and maintain the existing order but it’s more often violent and changes

for example the roosevelt revolution to redistribute wealth was relatively peaceful and maintained the existing

internal order while the french revolution the russian revolution

and the chinese revolution were much more violent and led to new internal orders

this internal conflict makes the empire weak and vulnerable to rising external

rivals who seeing this domestic weakness are more inclined to mount a challenge

this raises the risk of great international conflict especially if the rival has built up a comparable military

defending oneself and one’s empire against rivals requires great military spending

which has to occur as domestic economic conditions are deteriorating and the

empire can least afford it since there is no viable system for peacefully adjudicating international

disputes these conflicts are typically resolved through tests of power [Music]

as bolder challenges are made the leading empire is faced with the difficult choice of fighting or

retreating fighting and losing is the worst outcome but retreating is bad too as it cedes

progress to the rival and signals that the empire is weak to those countries that are considering which side to be on

poor economic conditions cause more fighting for wealth and power which inevitably leads to some kind of war

wars are terribly costly at the same time they produce the tectonic shifts

that realign the new waters to the new realities of wealth and power

in the world when those holding the reserve currency and debt of the declining empire lose faith and sell

them that marks the end of its big cycle of the roughly 750 currencies that

existed since 1700 less than 20 percent now exist and all of them have been devalued

for the dutch this happened after their defeat in the fourth anglo-dutch war when they weren’t able to repay the

massive debts they built up during it this led to a run on the bank of amsterdam

and a desperate sell-off forcing massive money printing

which devalued the currency and the empire into irrelevance

for the british this happened after world war ii when despite their victory they could

not repay the massive debts they borrowed to fund their war effort this led to a series of money printing

devaluations and sell-offs in the british pound as the us and the dollar emerged

dominant and created a new world order at the time of this recording the united

states hasn’t yet reached this point while it has massive debt it spends more

than it earns and funds this deficit with more borrowing and printing huge amounts of new money

the big sell-off in dollars and dollar debt hasn’t yet begun and while there are great internal and

external conflicts occurring for all the classic reasons they’ve not yet crossed the line to become wars eventually out

of these conflicts whether they’re violent or not come new winners who get together and

restructure the losers debts and political systems and establish the new world water

then the old cycle and empire ends and the new one begins

and they do it all over again that’s a lot of detail i just threw at you to paint a picture of how the

typical big cycle transpires of course not all of them transpire in exactly

this way but most largely do so much so that it seems like the stories of rises

and declines stay essentially the same and the only things that change are the clothes the characters wear and the

technologies they use so where are we heading

most empires have their time in the sun and inevitably decline [Music]

reversing a decline is difficult because that requires undoing a lot that’s already been done but it’s possible

by looking at these indicators it’s pretty easy to see which stage of the big cycle an empire is in

how fit it is and whether its condition is improving or worsening

which can help one estimate how many years it has left still

these estimates aren’t precise and the cycle can be extended if those in charge pay attention to their vital signs and

improve them for example knowing that a person is 60 years old

how fit they are whether they smoke or not and a few other basic vital signs

one can estimate the person’s longevity [Music] one can do that with empires and their

vital signs too it won’t be precise but it will be broadly indicative and

give clear direction on steps to take to increase longevity it’s most often the case that a nation’s

greatest war is with itself over whether or not it can make the hard

decisions needed to sustain success as for what we need to do it comes down

to just two things earn more than we spend and treat each other well

all other things i mentioned strong education inventiveness being competitive and all the rest

are just ways of getting at these two things it’s easy to measure if we’re doing them

so like people who want to get fit let’s get on the program and improve our

vitals let’s do that individually and collectively

my goal for sharing this picture of how the world works and a few principles for dealing with it well is to help you

recognize where we are and the challenges we face and to make the wise decisions needed to

navigate these times well [Music]

since there is a lot more to discuss and we are out of time you can learn more in my book principles for dealing with the

changing world water and i look forward to continuing this conversation at

economicprinciples.org and on social media thank you and may the force of evolution

Pingback: Ray Dalio The Changing World Order Commentary – Crypto Trader

Pingback: Ray Dalio Changing World Order Commentary - Prepper Survival

Pingback: Catherine Austin Fitts On US Government Corruption – Crypto Trader

Pingback: How To Use Dark Web Tutorial 2022 – Crypto Trader

Pingback: The 10 Most Dystopian Things Pushed By The World Economic Forum – Crypto Trader

Comments are closed.